Ways to Give

At the Rock Valley College Foundation, we are dedicated to assisting you in making a meaningful impact through your charitable giving. We understand that donating is a personal choice, and we strive to help you find the most efficient and financially advantageous way to contribute that aligns with your values and charitable goals.

We believe that giving back is a compassionate act that brings great joy to both the donor and the recipient. With your help, together we can create exceptional and accessible educational opportunities for our students that will allow them to reach their full potential and make positive changes in our community and beyond. We appreciate your generosity and are proud to be a part of your journey toward making a difference at RVC.

Our team places a high priority on maintaining the confidentiality and security of your personal and financial information. We utilize the latest technology and industry-standard security measures to ensure that your information is protected at all times.

Donation Methods & Programs

Online

By using our secure online giving system, you can easily support any of our campuses, initiatives, or programs while saving time and eliminating postage. The transaction process is encrypted to ensure your safety.

You have the option to make a one-time gift or set up recurring payments online using your credit card. Our online giving form is easy to use and allows you to select the area you wish to support and enter the amount you wish to give.

If you need to modify your existing recurring gift, you can contact us by email or phone at (815) 921-4500 to make changes to your payment amount, frequency, designated fund, update your credit card information, or cancel your credit card in case of loss or theft.

Please note that we cannot accept credit card information via email or fax to ensure the security of your gift.

Give by Mail

Please make gifts by check or money order payable to the “Rock Valley College Foundation.”

Please also include a short note (or memo on your check) stating the purpose or designation of your gift.

Please address as follows:

Rock Valley College Foundation

3301 N Mulford Rd

Rockford, IL 61114

Electronic Funds Transfer (EFT)

Donating to the Rock Valley College Foundation through Electronic Funds Transfer (EFT) is a secure, fast, and convenient way to support our mission of providing quality education to our students. EFT transactions are processed through secure channels, ensuring that your personal and financial information is protected. As your donation will be automatically deducted from your bank account, you can have peace of mind knowing that your donation will directly support the Rock Valley College Foundation without the risk of lost or stolen checks.

To donate to the Rock Valley College Foundation via EFT, follow these simple steps:

- Choose an amount that is meaningful to you.

- Gather account information and wiring instructions for the RVC Foundation.

- Receiving Bank: Midland States Bank, 1201 Network Centre Dr., Effingham, IL 62401

- Beneficiary: Rock Valley College Foundation, 3301 N. Mulford Road, Rockford, IL 61114

- Receiving Bank ABA (Routing) #: 081204540

- Beneficiary Account #: 718927

- Contact your financial institution to request the transfer.

- Contact us at (815) 921-4500 or email [email protected] to inform us of your gift.

- Look for a tax receipt and acknowledgement letter from us to ensure your gift was processed.

Gifts of Stock

Giving a gift of stock is a simple process that comes with many benefits. Not only can you make a significant impact on our ability to provide resources and support to our students, but you may also receive a tax deduction for the full fair market value of the stock at the time of the donation, as well as potentially avoid paying capital gains taxes on the appreciation of the stock.

To make a gift of stock to the Rock Valley College Foundation, follow these steps:

- Choose what type of stock and how many shares you want to donate. You’ll need to know the name of the stock and its ticker symbol if it is publicly traded stock.

- Gather account information and wiring instructions for the RVC Foundation. Please

make sure your advisor or broker has the following wiring instructions:

- DTC ID #: 0188

- Credit to: Rock Valley College Foundation, EIN # 36-3037232, Account Number: (Choose

one of those listed below), 3301 North Mulford Road, Rockford, IL 61114

- Account # 928-034693 – Capital Campaign

- Account # 928-034694 – Endowment

- Account # 928-034698 – Major Gift

- Account # 928-034740 – Operating

- Download and fill out the Stock Transfer Form

- Contact your financial institution to request the transfer.

- Return the completed form to the address provided or email it to [email protected] to inform us of your gift.

- Look for a tax receipt and acknowledgement letter from us to ensure your gift was processed.

- Report the stock donation when you file your tax return. Please use the following

legal name and tax identification:

- EIN # 36-303723

- Rock Valley College Foundation, 3301 North Mulford Road, Rockford, IL 61114

Matching Gifts

Employer-matching gift programs are a wonderful way to amplify the impact of your donation to the Rock Valley College Foundation. By taking advantage of this program, your employer will match your donation, effectively doubling the impact of your gift. This means that you can make an even greater impact on the causes that matter to you without having to increase your donation.

To see if your employer offers a matching gift program, simply check with their human resources department. If they do offer this benefit, they can guide you through the process of submitting your donation and requesting a match.

Corporate Sponsorships

Working with the Rock Valley College Foundation can bring significant benefits to both the students at RVC and your business. By becoming a corporate sponsor, you can support your community's higher education and workforce development. Your generosity can help fund scholarships, enhance academic programs, and provide resources to support student success.

Being a corporate sponsor not only helps make a positive impact in the community, but it can also boost your business's reputation and visibility. You'll have opportunities to showcase your business through marketing and advertising materials, events, and other initiatives. Your sponsorship can also provide valuable networking opportunities, allowing you to connect with other business leaders, community members, future employees, and potential customers.

The Rock Valley College Foundation offers different levels of sponsorship and benefits that can be tailored to your business's needs. You can choose to sponsor RVC Foundation events, RVC Athletics Programs, Starlight Theatre, or a variety of activities and programs across our campuses.

Join us in supporting our community's higher education and workforce development by supporting RVC through the Rock Valley College Foundation. Contact the Foundation at [email protected] or (815) 921-4500 to learn more about the sponsorship levels and benefits.

Unrestricted Gifts (RVC Fund for Immediate Impact)

An unrestricted gift to the RVC Fund is a flexible and powerful form of support because it allows the Rock Valley College Foundation to direct the funds where they are most needed, including student support, operational support, enhancements to the learning experience and more.

Unrestricted funds provide a pool of available resources that can be used to carry out the mission of the RVC Foundation that may not be covered by other funding sources. This means that unrestricted gifts can be used to address current and often time-sensitive needs, while also giving the Foundation the flexibility to make strategic decisions that can have a lasting impact on our students and community.

Any gift type (by mail, online, EFT, payroll deduction, etc.) can be an unrestricted gift. Simply note “RVC Fund” in the designation portion of your donation form.

Designated Gifts

Designated funds allow you to direct your support to the cause or program that matters most to you. To make a designated gift, simply indicate the area or program you wish to support by including a short note (or memo on your check) when you make your donation.

Designated funds can be used for a range of causes, including:

- Scholarships

- Athletic programs

- Student Clubs and Organizations

- Student Emergency Relief

- Building or renovation projects

If you are unsure of which program or area to support, contact our team and we'll guide you through the process and provide you with a list of possible areas to donate to.

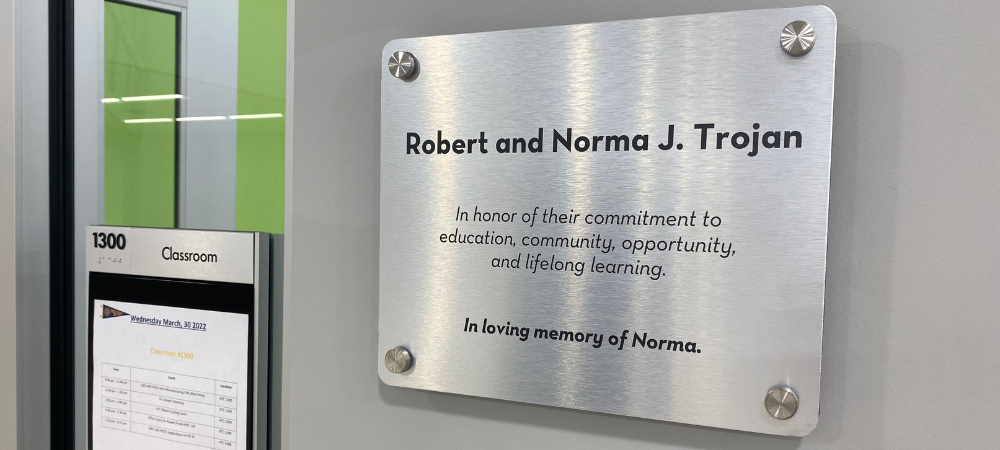

Honor, Memorial, or Tribute Gifts

Donating to the Rock Valley College Foundation as an honor, memorial, or tribute is a wonderful way to celebrate the life of a loved one, recognize a special occasion, or express gratitude to someone who has made a positive impact on your life. These gifts can also be a meaningful way to support the College and its mission.

When you donate in honor of someone special, we will notify the honoree or their family of your gift. If you are making a gift in memory of someone who has passed away, we will send an acknowledgment to the family, letting them know of your thoughtful contribution. You can also choose to have your donation remain anonymous if you prefer.

Your gift can support any area of the College that you choose, from scholarships to technology upgrades to the area of greatest need. We will work with you to ensure that your gift is used in a way that honors the person being recognized.

Depending on the gift, there are different ways to recognize you or your loved one. The recognition may include, but are not limited to: the honoree's name engraved on a tree or bench plaque, naming opportunities on a classroom or building, or a name-endowed fund to create a lasting legacy through a scholarship or program grant.

Planned Giving

No matter the size of your assets, whether it be a few stocks or a range of financial holdings and real estate, careful consideration of what to donate can help maximize the tax benefits associated with charitable giving. By choosing the right asset to donate, donors can significantly increase the cost-effectiveness of their gift. This can be a gratifying experience for donors, knowing that their gift is being put to good use and making a meaningful difference. The Foundation can provide guidance and assistance to help donors evaluate their options and make informed decisions about their giving. (EIN: 36-3037232)

A charitable remainder trust (CRT) is a type of trust that allows you to donate assets to the Rock Valley College Foundation while still retaining the income generated from those assets during your lifetime. The trust is structured so that after your lifetime or a specified period, the remaining assets are transferred to the Foundation.

A CRT offers many benefits, including potential income tax savings and the ability to receive income from donated assets during your lifetime. You can also receive an immediate income tax deduction for a portion of your gift. Additionally, by donating appreciated assets to the CRT, you can avoid capital gains taxes that would be due if you sold the assets.

There are two main types of CRTs: charitable remainder unitrusts and charitable remainder annuity trusts. A unitrust pays out a fixed percentage of the trust’s value each year, while an annuity trust pays out a fixed dollar amount each year. Both types of trusts offer flexibility in structuring your gift and can be tailored to meet your individual financial and philanthropic goals.

A CRT is a powerful tool for donors who wish to make a significant gift to the Rock Valley College Foundation while also preserving income from their assets during their lifetime. Please consult with your financial and legal advisors to determine if a CRT is right for you.

Life insurance can play an important role in charitable gift planning, but it is often overlooked. One of the benefits of life insurance is that it can be used as the direct funding medium for a charitable gift, allowing you to make a significant contribution (equal to the face value of the policy) for a relatively small annual payment (i.e., the premium payment). If you want to make a substantial gift to the Rock Valley College Foundation but are unable to do so through your current income or other assets, this could be an excellent option for you. By naming the Foundation as the beneficiary of your life insurance policy, or one of the beneficiaries of your plan through a percentage, you can create a lasting legacy that will benefit future generations of students.

To name Rock Valley College Foundation as the beneficiary of your life insurance policy, you need to contact your insurance company or agent and request a change of beneficiary form. On the form, you will need to provide the name and tax identification number of the Rock Valley College Foundation, as well as the percentage of the policy proceeds that you wish to leave to the charity. Once you complete the form and submit it to the insurance company, the RVC Foundation will be notified of the policy designation.

A bequest is a gift that is made to a nonprofit organization through a person's will or living trust. By including Rock Valley College in your estate plans, you can support the college's mission and make a lasting impact on the lives of students for generations to come.

Creating a bequest is a simple process that involves adding a clause to your will or trust that specifies the gift you would like to make to the Rock Valley College Foundation. This can be a specific dollar amount, a percentage of your estate, or even a piece of property. By working with your attorney or financial advisor, you can ensure that your wishes are clearly stated and legally binding.

There are many benefits to donating via bequest. You can retain full control of your assets during your lifetime and enjoy the flexibility to change your plans at any time. You may also be able to reduce your estate tax liability, leaving more of your assets to your loved ones.

We understand that creating a bequest can be a deeply personal and emotional decision. We encourage you to consult with your attorney or financial advisor to determine if a bequest is a right choice for you. If you have already included the Rock Valley College Foundation in your estate plans, we would be honored to recognize you as a member of our Heritage Society. Please contact us to learn more about this special recognition.

A donation to a charitable organization through a retirement plan is called a Qualified Charitable Distribution (QCD) and may be an ideal option for individuals who are age 70½ or older and have accumulated assets in an IRA, 401(k) plan, profit-sharing plan, Keogh plan, or 403(b) plan. QCDs allow these individuals to donate up to $100,000 per year directly from their plan to a qualified charity without having to count the distribution as taxable income. The QCD can be used to satisfy all or a portion of the Required Minimum Distribution (RMD) for the year, which is the minimum amount that an individual must withdraw from their traditional retirement plan or employer-sponsored retirement plan each year once they reach the age of 72.

Please consult with your financial and legal advisors to determine if a QCD is a right choice for you. And when you're ready to make your gift, we are here to help.

A Donor Advised Fund is a charitable giving account that is created and managed by a public charity. When you donate assets to a Donor Advised Fund, you receive an immediate tax deduction for the full value of the assets, but you can recommend how the funds are distributed to the charities of your choice over time.

To create a Donor Advised Fund, you can work with a community foundation or other public charity that offers this type of account. You will need to make an initial contribution to establish the fund, and then you can make additional contributions over time. Once your fund is established, you can recommend grants to the Rock Valley College Foundation or other qualified charities. The public charity that manages your fund will take care of all of the administrative tasks associated with distributing the funds.

Reinvestment Fee Information

At the RVC Foundation, we are committed to being exceptional stewards of every gift entrusted to us. This means providing timely gift receipts, ensuring the accuracy of donor records, carefully disbursing funds according to donor intent, keeping you informed about the impact of your generosity, and more.

Since 2017, the RVC Foundation has been a self-funded organization, relying on philanthropic support rather than College funding to sustain our operations. In order to cover the costs associated with processing gifts, administering scholarships, stewarding donor relationships, and expanding fundraising efforts to provide more opportunities for students, a 6% Reinvestment Fee is applied to all new gifts received.

We understand that transparency is key, and we want donors to feel confident in how their gifts are being managed. Below are answers to common questions about how this reinvestment helps us continue serving RVC students.

The 6% Reinvestment Fee is a one-time fee applied to all new donations to support the RVC Foundation’s operations. Because we are self-funded, this reinvestment allows us to:

- Steward and manage donor gifts responsibly

- Administer scholarships effectively

- Provide financial oversight and transparency

- Ensure the Foundation's long-term sustainability

Without this reinvestment into our mission at the Foundation, the operational costs of managing funds would reduce the resources available for students.

The 6% reinvestment fee is applied at the time your gift is received, while the remainder is directed toward the fund or program you’ve chosen to support, ensuring that your impact is felt exactly where you intend.

No, it does not. The full amount of your contribution remains tax-deductible to the extent allowed by law.

Absolutely! Many donors choose to adjust their contribution so their full intended amount supports the fund or program they’re passionate about.

If you have questions about how to make this adjustment, please contact us. We are happy to help!

Yes! Most colleges, universities, and nonprofit foundations implement similar fees to support their operations. These fees generally range from 3% to 15%. We are committed to remaining budget conscious so that our 6% reinvestment fee remains low and aligns with industry best practices, while still ensuring donor impact remains a priority.

All reinvestment fee funds are applied to the Foundation’s unrestricted budget to support the ongoing costs of managing donor contributions and carrying out the important work for which you’ve intended.

The RVC Foundation Board reviews this policy annually, and any changes require a majority board vote.

We’re happy to discuss this with you! If you have any questions, please reach out to Brittany Freiberg, Chief Development Officer, at (815) 921-4502 or [email protected].